Hey there, curious minds! Ever wonder what’s really going on with all the tax talk? It can sound like a secret code sometimes, right? Well, today, we're going to peek behind the curtain and chat about one of the biggest tax shifts in recent history: the one associated with Donald Trump, specifically the Tax Cuts and Jobs Act of 2017 (TCJA), and what might be brewing for the future, especially with whispers about something called the "Working Families Breakthrough of 2026." Think of it like this: tax policy is kind of like a giant recipe book for the economy, and these acts are like big, bold revisions to some of the most important ingredients.

So, let's rewind to 2017. What was the big deal with the TCJA? Imagine the government saying, "Okay, businesses, we're going to give you a significant discount on your taxes!" That was a major part of it. The corporate tax rate, which was sitting pretty high at 35%, got a hefty chop down to 21%. Why would they do that, you ask? The idea was to make American businesses more competitive on the global stage. Think of it like a company saying, "If I have less overhead (taxes), I can invest more in my own operations, hire more people, or even expand to new markets." It was a bet on the idea that these savings would trickle down and stimulate the economy.

And what about us, the everyday folks? For individuals, the TCJA also brought changes. It wasn't as dramatic as the corporate tax cuts, but many people saw their income tax rates go down. Plus, the standard deduction got a nice boost. For those who don't itemize their deductions, this basically meant a bigger chunk of their income was no longer subject to taxes. So, for many, it felt like having a little more money in their pocket come tax season. It was like getting a surprise bonus, even if it was just a bit less being taken out of your paycheck each month.

But tax policy isn't usually a "set it and forget it" kind of deal. Laws have expiration dates, and the TCJA included provisions that were designed to expire. This is where the conversation starts to shift towards the future, specifically around 2026. The buzz about a "Working Families Breakthrough" in 2026 hints at a potential refocusing of tax policy. What could that mean? Well, the name itself gives us a big clue. It suggests a policy that's specifically designed to benefit families and the folks who are out there working hard every single day.

Let's dig into what this "Working Families Breakthrough" might look like. One possibility is a renewed emphasis on tax credits that directly help families. Think about things like an expanded Child Tax Credit. For parents, this can be a game-changer, helping to offset the costs of raising children, which, let's be honest, are considerable! It's like a little financial relief valve for busy households. Or maybe we'll see enhancements to credits for things like childcare or education, making it easier for parents to work and for individuals to upskill.

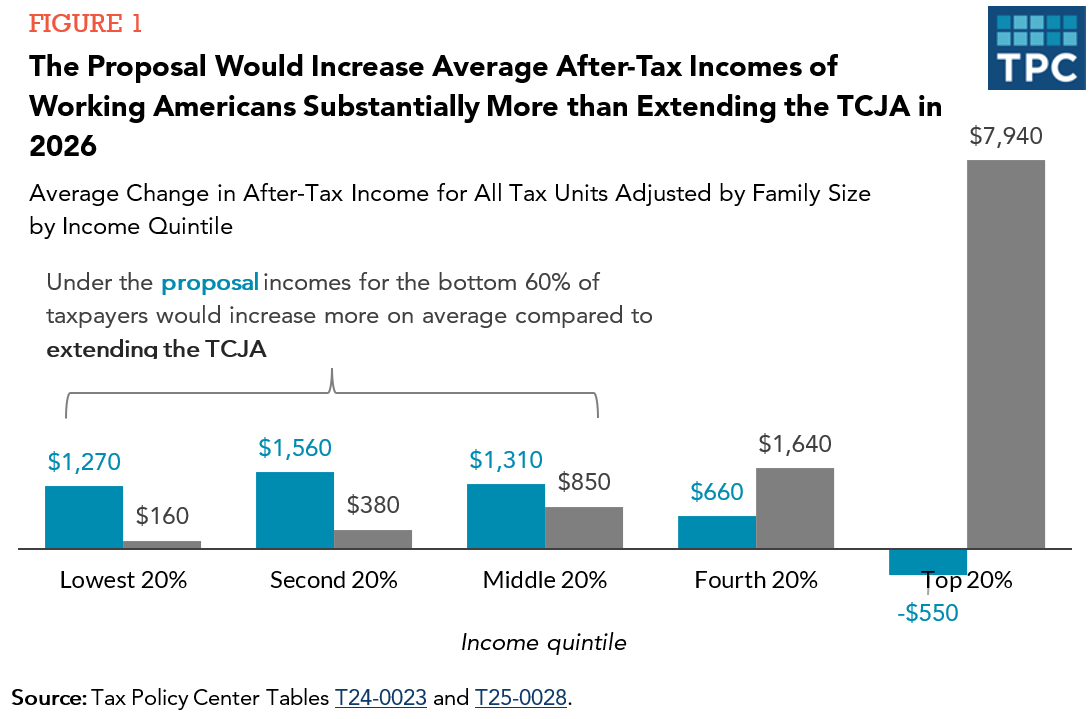

Another angle could be adjustments to the income tax brackets themselves. Perhaps the idea is to lower taxes for middle- and lower-income families, while the wealthiest might see a different story. It’s a bit like rebalancing a scale, trying to ensure that the tax burden is distributed in a way that feels fair and supports the broadest segment of the population. Think of it as fine-tuning the engine of the economy to run more smoothly for everyone.

Why is this future-facing talk so interesting? Because tax policy touches everything. It influences how businesses operate, how much money we have to spend, and what kind of investments are made in our communities. The TCJA was a massive policy experiment, and its effects are still being debated and analyzed. Now, as we approach 2026, the conversation is turning towards what comes next. Will the focus remain on broad-based tax cuts, or will it pivot to more targeted support for families?

(2).png.webp?itok=KHrJFjgR)

The "Working Families Breakthrough" concept feels like a deliberate signal. It's not just about tinkering around the edges; it suggests a desire to make a significant positive impact on the lives of working families. This could mean more disposable income for essential needs, better opportunities for education and childcare, and ultimately, a stronger sense of economic security for millions of Americans. It’s like shifting the spotlight to shine brighter on the backbone of the economy – the people who show up to work every day.

Of course, no tax policy is without its critics or complexities. There are always questions about who benefits the most, how the government will fund its operations, and the long-term economic consequences. But understanding these shifts, from the big corporate tax cuts of 2017 to the potential family-focused changes on the horizon, is key to understanding the forces shaping our economic landscape. It’s like following a fascinating narrative, where each chapter brings new plot twists and potential outcomes.

So, as we look towards 2026 and beyond, keep an ear out for more discussions about tax policy. The idea of a "Working Families Breakthrough" is a compelling one, suggesting a future where tax laws might be more directly aligned with supporting the everyday lives and aspirations of American families. It’s a reminder that the choices made in Washington have real-world impacts, and the ongoing evolution of tax policy is a story worth following.