Hey there, money nerds and curious cats! Let's dive into something that’s been buzzing around the water cooler and probably making your wallet do a little jig: Trump's tax bill. Remember that massive tax overhaul? Yeah, the one that sent ripples through pretty much everything. Now, with inflation doing its best impression of a runaway greased pig, we gotta ask: is this tax bill, specifically those chunky refunds, actually helping you and me keep our heads above the rising price tide?

It’s a bit like a financial puzzle, isn't it? One piece is this huge tax cut, and the other is everything suddenly costing, well, more. So, are we getting a financial superhero or just a slightly larger band-aid? Let's break it down, with a sprinkle of fun, of course!

The Big Tax Party: Remember the Good Ol' Days?

Back in the day, before the price of eggs resembled a small fortune, we had this thing called the Tax Cuts and Jobs Act of 2017. Fancy name, right? It was a big deal. Think of it as a giant party thrown for businesses and, to some extent, individuals. The idea was to inject some serious cash into the economy.

Businesses got a hefty tax cut. Like, really hefty. The corporate tax rate went from a whopping 35% down to 21%. That’s more money for companies to do… well, whatever companies do with money! Invest, expand, maybe buy a fancier coffee machine for the breakroom? Who knows!

And for us regular folks? We saw changes too. Many people got to keep a bit more of their paycheck. The tax brackets shifted, and some deductions got tweaked. It was a bit of a mixed bag, honestly. Some people cheered, some scratched their heads, and some probably just shrugged and went back to scrolling through cat videos.

The "Refund" Ripple Effect: More Money in Your Pocket?

Now, the fun part for many of us was the tax refund. For some, those refunds were, dare I say, epic. We’re talking amounts that might have made you think, "Wow, I can finally buy that ridiculously oversized inflatable flamingo!" or "Finally, I can upgrade my ancient microwave!"

This is where the intrigue kicks in. The theory was that if people have more money, they'll spend it. And when they spend it, businesses do better, jobs are created, and the economy, as a whole, gets a nice little boost. It's like tossing a handful of confetti into the wind – you hope it lands somewhere good!

But here’s the quirky twist. While some folks saw their refunds get fatter, the actual impact on individual households was… well, let’s just say it wasn't a uniform slam dunk. Some people's tax bills went down a lot, others saw a modest dip, and a few might have even seen their bills go up due to certain changes. It was a bit of a financial lottery, depending on your specific tax situation.

Think of it this way: Imagine you’re at a buffet. Some people piled their plates high with the salmon, others went for the mystery casserole. Everyone got something, but what they ended up with was pretty different!

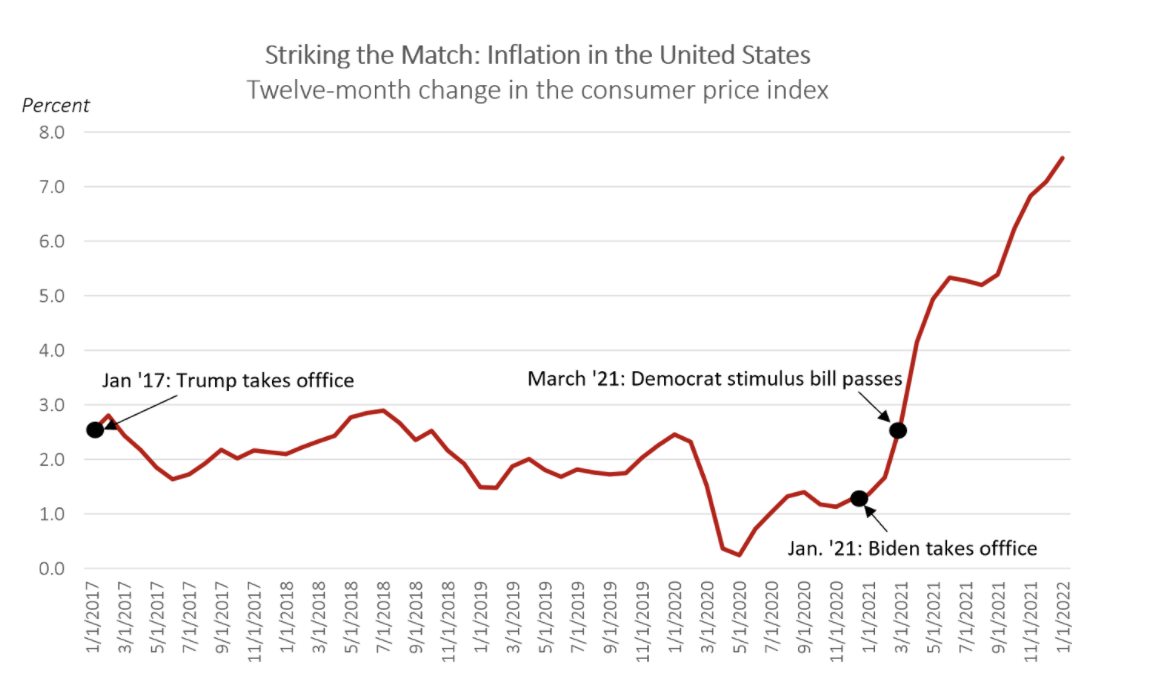

Enter the Inflation Monster: Roaring and Raiding Wallets

Then, like a scene from a B-movie, inflation decided to make a grand entrance. Suddenly, that latte you used to grab for $3 now costs $5. Your grocery bill looks like it’s been inflated by a helium balloon convention. Gas prices? Don’t even get me started. It’s like the economy decided to play a prank, and our wallets are the punchline.

Inflation is basically when your money doesn't buy as much as it used to. It’s like having a superhero costume that’s suddenly too small. The idea of power is there, but the reality is a bit of a squeeze.

And this is where our tax bill and inflation have this… interesting showdown. On one side, you have the potential extra cash from tax refunds. On the other, you have the relentless march of rising prices eating away at that cash. It’s a bit like trying to fill a leaky bucket with a teacup.

Did the Refunds Fill the Gap? The Million-Dollar (or maybe just the $50) Question

So, the big question: did those record refunds from Trump's tax bill actually help offset the sting of inflation? The answer, as with most things involving money and politics, is a resounding… it’s complicated.

For some people, absolutely! If you got a substantial refund and your essential expenses didn’t skyrocket *too dramatically, that extra cash might have felt like a lifesaver. It could have covered a few extra grocery trips, a tank of gas, or perhaps that much-needed home repair that you’d been putting off.

But for many others, especially those on tighter budgets, those refunds might have felt like a fleeting moment of relief. The money probably went straight to paying bills that had suddenly gotten much, much bigger. It was like getting a tiny umbrella during a hurricane – it’s something, but it’s not exactly a fortress.

Here’s a fun detail: economists have opinions on this. Some argue that the tax cuts, by putting more money in people's hands, might have even contributed to inflation by increasing demand when supply was already struggling. It's like everyone suddenly wanting to buy the last slice of pizza at the same time – the price is bound to go up!

Others say that the refunds were a drop in the bucket compared to the sheer force of global economic factors driving inflation. Think of it as blaming a single raindrop for causing a flood. It’s probably a bit of an oversimplification.

The Quirky Economics of It All

What makes this whole discussion so… entertaining is the sheer complexity. It’s not a simple "yes" or "no." It’s a tangled web of individual circumstances, business decisions, and global economic forces. It's like trying to solve a Rubik's Cube blindfolded while juggling flaming torches!

Think about this: a business might have used its tax savings to invest in new equipment, which could eventually lead to lower prices if it boosts efficiency. Or, they might have used it to buy back their own stock, which is great for shareholders but doesn't necessarily put more cash in your pocket for groceries.

And the refunds? Were they a temporary boost or a sustainable change? For many, they were a one-time infusion of cash. Inflation, on the other hand, is like that guest who overstays their welcome and eats all your snacks.

The real kicker is that your personal experience with the tax bill and inflation is probably unique. Did you get a big refund and your rent stayed the same? Lucky you! Did your grocery bill double and your tax refund was meager? That’s a tough spot.

It’s a constant balancing act, isn’t it? The government tries to stimulate the economy, and the economy, in its infinite wisdom, throws curveballs like inflation. And we, the folks trying to make our paychecks stretch, are left trying to figure out if that little bit of extra cash from Uncle Sam was enough to fend off the rising cost of, well, everything.

So, the next time you’re staring at your grocery receipt or filling up your gas tank and thinking about those tax refunds, just remember: it’s a wild ride! And while we might not have all the answers, it’s definitely more fun to chat about it than to just… worry about it.