Let's talk about something that can put a little extra jingle in your pocket come tax season – and it all has to do with your trusty set of wheels! If you're in the market for a new car or recently drove off the lot in one, you might be in for a pleasant surprise thanks to a new financial perk. Think of it as a little "thank you" from Uncle Sam for supporting American manufacturing. This isn't just about crunching numbers; it's about understanding how smart financial policies can translate into real savings for everyday folks. So, buckle up, because we're diving into a topic that's both practical and surprisingly popular – the "Made-in-America" Credit.

You've probably heard the buzz about boosting domestic production and supporting American jobs. Well, this new credit is a tangible way that policy is translating into benefits for consumers. At its core, the "Made-in-America" Credit is designed to incentivize the purchase of vehicles that are manufactured right here at home. It's a clever strategy to encourage consumers to choose American-made when making a significant purchase like a car. The big news for many is that this incentive can manifest as a sweet auto loan interest deduction, directly impacting your tax refund. Essentially, the government is saying, "You bought American, so let us help you out a little with the cost of financing." This isn't just a theoretical benefit; it's a concrete way to lighten the financial load associated with car ownership, making that dream car a little more attainable and your tax return a little fatter.

So, what's the big deal? The primary purpose of this credit is multifaceted. First and foremost, it's a powerful tool to stimulate the American automotive industry. By making American-made cars more attractive financially, the government aims to boost sales for domestic manufacturers, which in turn supports jobs in factories, supply chains, and dealerships across the country. It's a ripple effect that benefits many. For you, the consumer, the benefits are even more direct and exciting. The most significant advantage is the potential for a larger tax refund. By allowing you to deduct a portion of the interest paid on your auto loan for an eligible American-made vehicle, your taxable income is reduced. A lower taxable income generally means a lower tax bill, and if you've already paid more in taxes throughout the year than you owe, that difference comes back to you as a refund. Imagine getting a few hundred, or even a few thousand, extra dollars back when you file your taxes – that’s a pretty compelling benefit!

Furthermore, this credit can make the prospect of buying a new car more appealing. The added savings from the interest deduction can help offset some of the overall cost of vehicle ownership, which can be substantial. It adds another layer of value to choosing a domestically produced vehicle. For those who are already planning to buy a car, it's an excellent opportunity to maximize their financial return. It’s not just about the purchase price; it's about the total cost of ownership, and this deduction plays a role in that long-term financial picture. Think of it as a smart financial hack that aligns your car-buying decision with a tangible tax advantage.

Navigating the "Made-in-America" Waters

Now, you're probably wondering, "How do I get my hands on this sweet deal?" Like most tax credits and deductions, there are a few important details to keep in mind. The "Made-in-America" Credit is not a blanket offer for every car loan out there. The key criterion is that the vehicle must be manufactured in the United States. This means checking the origin of the vehicle you're interested in or have already purchased. Most manufacturers are quite transparent about where their vehicles are assembled, and you can usually find this information on their websites or by asking your dealer. The specifics of which vehicles qualify can also evolve, so staying informed is key. It’s always a good idea to consult with a tax professional or refer to the official guidelines from the Internal Revenue Service (IRS) to ensure you're meeting all the requirements.

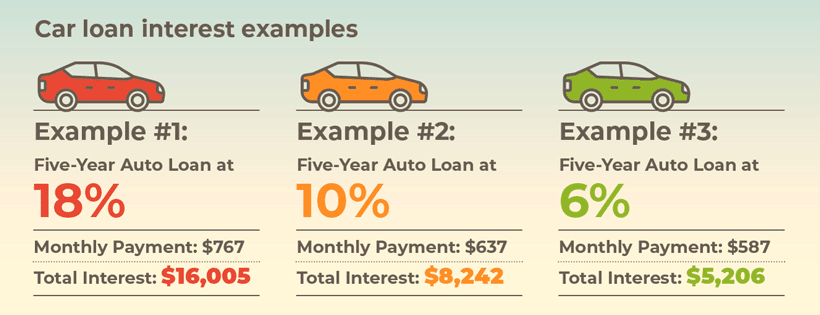

The deduction typically applies to the interest paid on your auto loan, not the principal amount. This is a common feature of many interest-related tax deductions. So, the more interest you pay over the life of your loan for an eligible vehicle, the greater the potential deduction. This can be particularly beneficial for loans with longer terms or higher interest rates. It's important to keep good records of your loan payments, as you'll need them when you file your taxes. This includes statements from your lender that clearly show the interest paid for the tax year in question.

The excitement around this credit stems from its direct impact on the average consumer's wallet. It turns a standard financial transaction – buying a car and financing it – into an opportunity for a significant tax benefit, all while supporting domestic industries. It's a win-win scenario that's hard to ignore!

The popularity of this initiative is understandable. It taps into a desire to support local economies and feel good about where your money is going. Plus, let's be honest, who doesn't appreciate a little extra cash back? This credit makes that feeling of patriotism and smart financial planning feel even more rewarding. It's a smart policy that’s making a real difference for car buyers across the nation. So, if you’re thinking about a new set of wheels, definitely do your homework on the "Made-in-America" Credit. It could be the key to unlocking a much more pleasant tax season and a happier car-owning experience.