Get ready to do a little happy dance, because the taxman might be taking a break from visiting your mailbox in 2026! A rather cheerful change is happening with the Standard Deduction, and it’s fantastic news for a whole lot of us. Think of it as a surprise bonus you didn’t have to work for.

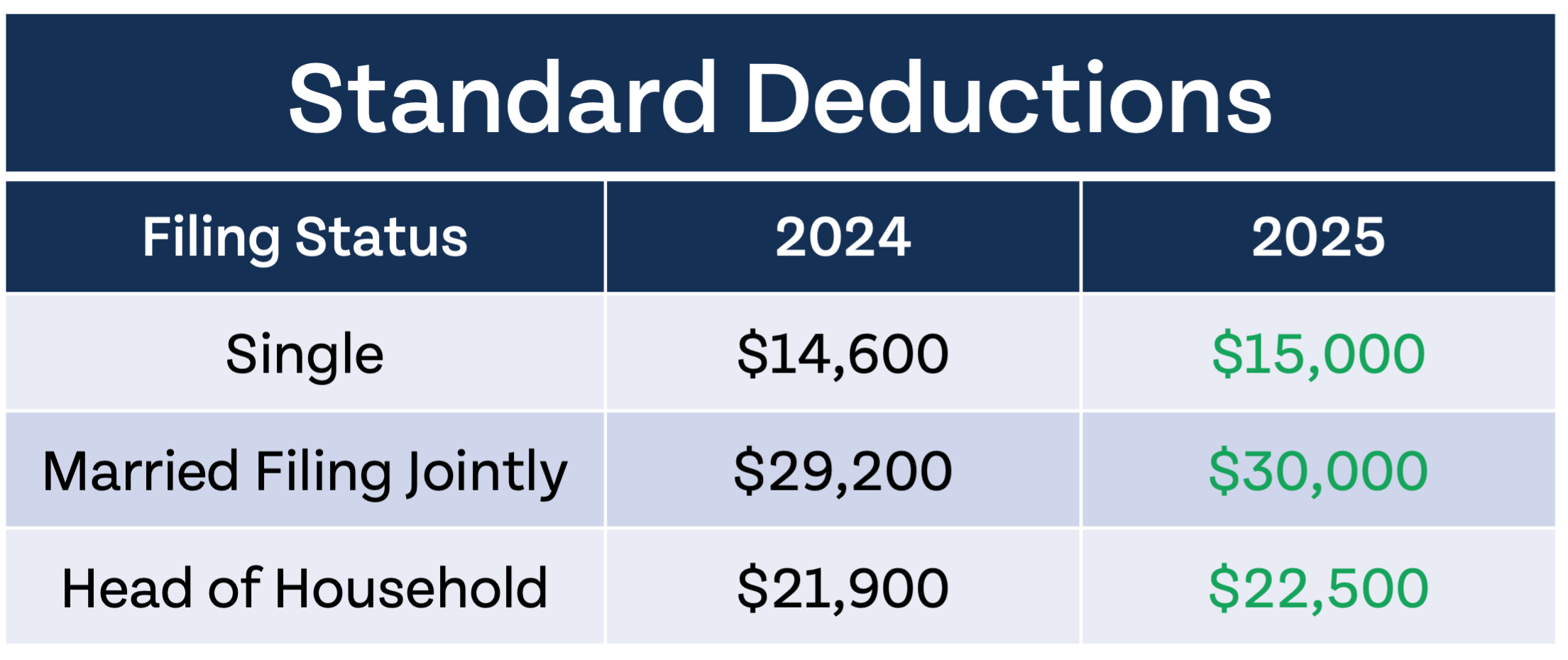

We’re talking about a bump up to a whopping $15,750 for individuals. That’s a significant chunk of change, and it means that a mind-boggling number of people might find themselves owing zero dollars come tax time. Imagine that – a tax return that’s all sunshine and no spreadsheets!

Now, what exactly is this magical Standard Deduction? It's basically a fixed amount that the government says you can subtract from your income before they start calculating how much tax you owe. It's like a pre-approved discount on your earnings.

Before, this discount was a bit smaller. But for 2026, it’s getting a major glow-up. This isn't just a tiny tweak; it's a seismic shift that’s going to change tax day for millions.

So, who are these lucky ducks? Mostly, it’s folks who don’t have a ton of complicated write-offs. If you’re not itemizing things like medical expenses or charitable donations because they don’t add up to more than the standard amount, this change is like a personal superhero swooping in.

Picture this: you’ve always dutifully filed your taxes, maybe with a sigh or two, knowing you’ll have to part with some hard-earned cash. But in 2026, that sigh might turn into a joyful whoop! The new threshold means your taxable income could shrink so much that it hits zero, leaving you with a glorious “no tax due.”

It’s like going to the grocery store and finding out that a whole aisle of your favorite snacks is suddenly free. Pure, unadulterated delight! This move is designed to simplify things for the average American and put more money back into your pockets, where it belongs.

Think about what that extra money could mean. Maybe it’s that weekend getaway you’ve been dreaming of, or finally getting around to fixing that leaky faucet. It could be investing in a new hobby, or simply having a bit more breathing room in your budget.

This isn't some abstract government policy that feels distant. This is about real people, real families, and the tangible impact of a smarter tax system. It’s about making life a little bit easier and a whole lot more affordable.

The $15,750 figure is a big deal because it’s a significant increase from previous years. This substantial rise means that a vast number of individuals will now fall below the taxable income line. It’s an economic boost delivered directly to the people.

Imagine the relief! For so many, tax season has always been a source of stress and financial anxiety. This change could transform it into a much more neutral, or even positive, experience. No more agonizing over receipts or worrying about making a mistake.

This is particularly impactful for those who are just starting out, or those on a fixed income. The extra money staying in their hands can make a world of difference. It’s about giving everyone a fairer shot and a little more security.

The Standard Deduction essentially acts as a floor, protecting your income from taxation. By raising that floor so high, the government is saying, “We recognize that you have expenses, and we’re giving you a generous allowance to cover them before we even talk about taxes.”

It’s a little like the government saying, “Okay, you’ve earned this much, but before we take our slice, here’s a big, fat chunk that’s completely yours, no questions asked!” And for 2026, that chunk is getting seriously fat.

This isn’t about complicated tax loopholes or fancy financial maneuvers. This is a straightforward, universally applicable benefit. It’s designed to be simple and effective for the vast majority of taxpayers.

So, while tax forms might still exist, the dread associated with them might start to fade for millions. This is a story of financial empowerment and a government looking out for its citizens in a surprisingly generous way.

Think about it: if your income after the Standard Deduction is $0 or less, congratulations! You’ve officially achieved the tax-free holy grail. It’s a quiet victory, perhaps, but a deeply satisfying one.

This change is a testament to the idea that tax policy can, and sometimes does, work in favor of the everyday person. It’s a positive development that deserves a bit of celebration. Let’s all raise a glass (or a humble cup of coffee) to the $15,750 Standard Deduction!

It’s a reminder that sometimes, good things do happen, and tax season might just become a lot less taxing. So, start dreaming about what you’ll do with that extra cash. The future is looking a little brighter, and a whole lot less taxable, for millions of us.

The beauty of the Standard Deduction is its simplicity. You don’t need a degree in accounting to understand it. You just need to know that for 2026, it’s gotten much, much better for you.

This isn't just about numbers on a page; it's about the feeling of relief that washes over you when you realize you owe less, or even nothing. It’s about reclaiming a piece of your financial freedom.

So, when tax season rolls around in 2026, remember the Standard Deduction. Remember that little boost that might just be saving you a bundle. It’s a quiet hero in the world of personal finance.

The government, in its infinite wisdom (or perhaps just a good mood!), has decided to give a significant reprieve to many. This isn't a handout; it's a smart adjustment that acknowledges the financial realities of many Americans.

So, go ahead, plan that vacation, buy that fancy gadget, or simply sleep a little easier knowing that a substantial portion of your income is now shielded from the tax collector. The $15,750 Standard Deduction is here to make your life just a little bit better.

It’s a testament to how policy changes can have a direct, positive, and surprisingly cheerful impact. The tax world just got a little friendlier, and that’s something worth smiling about.