Ever find yourself pondering the mysterious world of taxes? It might not sound like the most thrilling dinner party conversation, but understanding a few key concepts can actually be quite empowering. Today, let's dive into something called the SALT deduction cap, and why a potential hike in 2026 is particularly good news for folks living in so-called "blue states." Don't worry, we'll keep it light and breezy!

So, what exactly is this "SALT" thing? SALT stands for State and Local Taxes. For years, taxpayers have been able to deduct the state and local income taxes, sales taxes, and property taxes they pay from their federal taxable income. Think of it as a little bit of a tax break, helping to offset the burden of paying for schools, roads, and other essential services in your community. It was a way for the federal government to acknowledge that you're already contributing significantly to your local infrastructure.

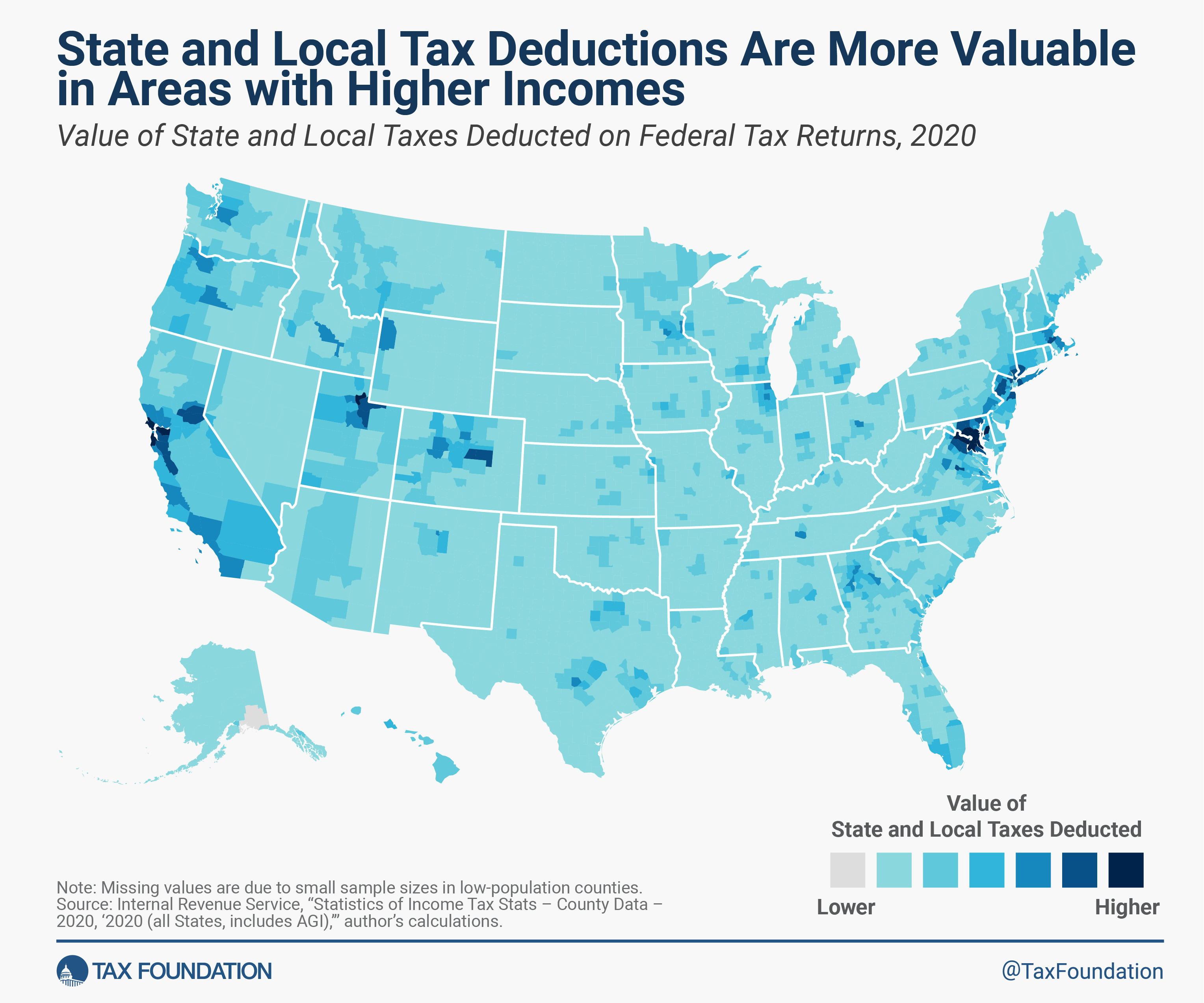

The catch, for a while now, has been a cap, or a limit, on how much of those SALT deductions you can claim. Currently, that limit is set at $10,000 per household per year. This has been a bit of a sore spot, especially in states with higher tax rates (often, but not exclusively, those leaning politically blue), where residents were paying well over $10,000 in state and local taxes. It felt like they were being penalized for living in areas with robust public services.

Now, here's where the exciting news comes in for 2026. There's a strong possibility, as current tax laws are set to expire, that this SALT deduction cap will be raised to a whopping $40,000. This is a massive win for taxpayers in states where local and state tax burdens are high. Imagine if you're paying thousands more in property taxes for your home in a good school district, or substantial state income taxes – a $40,000 deduction makes a significant difference in your overall federal tax bill. It could mean hundreds, or even thousands, of dollars back in your pocket each year.

Think about it in terms of everyday life. That extra money could help fund a child's college education, pay down a mortgage faster, or simply provide a bit more breathing room in your monthly budget. For educators, it could mean more resources for classrooms if families have a little extra disposable income. For local businesses, it can translate to more consumer spending. It's a ripple effect that benefits the entire community.

Curious to see how this might affect you? It's simpler than you think to get a general idea. You can easily look up the average state and local tax burden for your specific state. Many tax preparation software programs also allow you to input your income and deductions to see potential impacts. Even just understanding the concept of SALT is the first step. Don't be afraid to ask your tax professional about it during your next filing! It’s all about making our complex tax system a little more transparent and a little more fair for everyone.