Ah, tax season! For many of us, it's a bit like a rollercoaster – a thrilling, sometimes nerve-wracking ride that culminates in that sweet, sweet moment of a tax refund. Who doesn't love that unexpected windfall? It's like finding money in your favorite jeans, only on a much grander scale! This yearly ritual of filing our taxes is all about making sure we've played by the rules and, if we're lucky, getting a little something back from Uncle Sam.

The purpose of this whole system, at its core, is to ensure everyone contributes their fair share to the public good – funding roads, schools, defense, and countless other services that benefit us all. And for individuals, a tax refund can be a welcome boost. It can mean paying off debt, funding a much-needed vacation, tackling home repairs, or even just building up a rainy-day fund. It’s that little bit of financial breathing room that can make a big difference in our everyday lives.

We see the effects of this every year. Millions of Americans eagerly await their refunds, planning how they’ll spend that extra cash. For some, it’s a predictable part of their annual financial planning. They might factor it into saving for a large purchase or use it to smooth out cash flow during leaner months. Others might be pleasantly surprised by a larger-than-expected refund, a delightful bonus that allows for spontaneous splurges or accelerated financial goals.

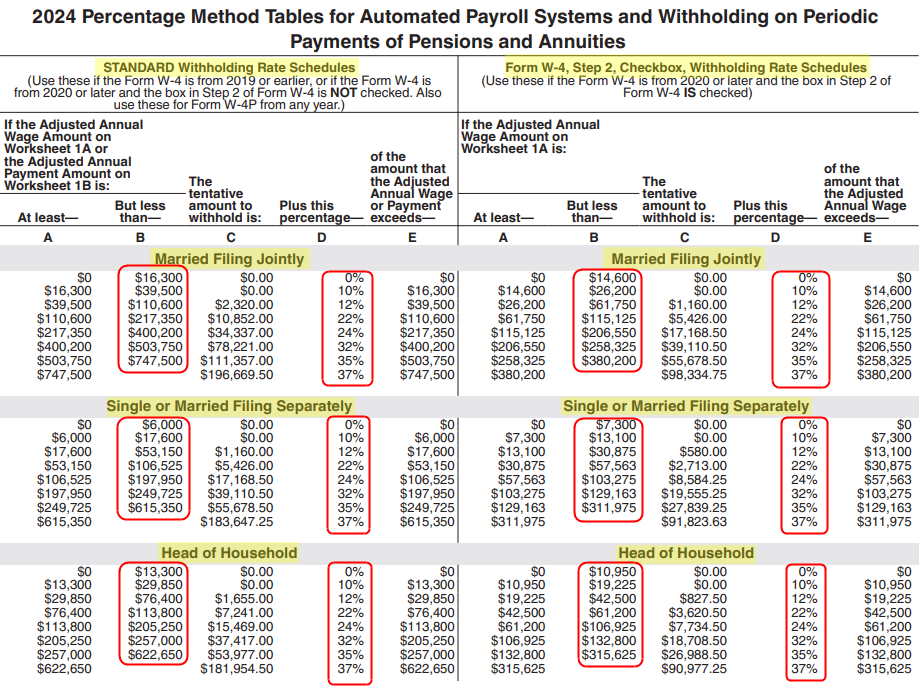

Now, this year, there's been a bit of buzz around why some refunds might be looking particularly healthy. Whispers among tax experts suggest a potential culprit: a slight lag in the IRS's system updates. You see, the government adjusts withholding tax rates throughout the year, and it takes time for these changes to fully filter through to everyone's paychecks. Some believe the IRS might have been a tad slow to implement all the latest tweaks to these withholding tables. This means some taxpayers may have had too much money withheld from their paychecks throughout the year, leading to larger refunds when they finally filed.

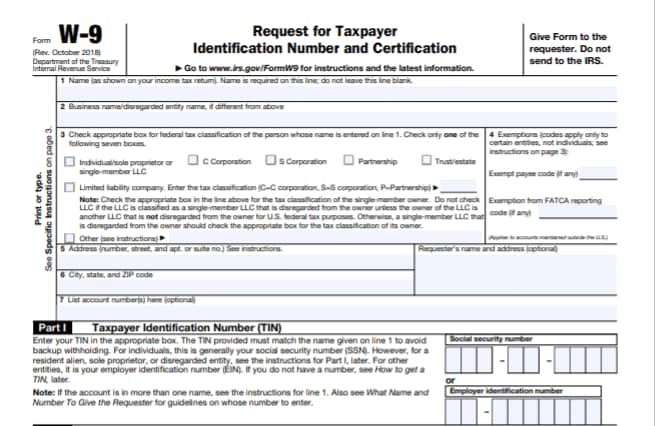

So, how can you make the most of this tax season, regardless of your refund size? For starters, stay informed. Keep an eye on official IRS communications and reputable financial news sources to understand any changes that might affect you next year. If you're expecting a refund, plan ahead. Don't let it disappear in a puff of impulse buys! Consider setting specific goals for your refund, whether it's investing, debt reduction, or saving. And for those who find their withholding is consistently too high, talk to your employer's HR department or a tax professional about adjusting your W-4 form. This way, you can potentially have more money in your paycheck throughout the year, rather than waiting for a lump sum later. Ultimately, understanding the system and being proactive is the best way to navigate tax season and ensure your finances are working as hard as possible for you!