Hey there, savvy shoppers and money-minded folks! Let's dive into something that might sound a bit dry but is actually super relevant to your everyday life: the curious case of the 2026 Inflation Spike. Why is this fun? Because understanding how the world around us affects our hard-earned cash is like unlocking a secret level in the game of life. It’s the difference between scratching your head at a higher grocery bill and knowing exactly why it’s happening. Think of this as your friendly neighborhood guide to deciphering those cryptic economic headlines and, more importantly, how they translate directly to your wallet. We're about to connect the dots between big government decisions and those little (or not-so-little) price tags you see every day.

So, what's the big deal with these new tariffs that started popping up? At their core, tariffs are essentially taxes that countries place on imported goods. Imagine your favorite gadget, maybe that super-fast coffee maker or that stylish jacket, is made in another country. When it comes into our country, the government slaps on an extra charge – that’s the tariff. Sounds simple enough, right? Well, the ripple effect can be surprisingly widespread, and understanding this connection is key to navigating the economy.

The Tariff Tango: How Imports Get Pricier

The most direct impact of tariffs is on the price of imported goods. If a tariff is placed on, say, Italian leather shoes, the company importing them will likely pass that extra cost on to you, the consumer. So, those fabulous shoes that used to cost $200 might suddenly be $230. It's not just about the shoes, though. Many products are made up of parts from different countries. If a tariff is placed on a component used to make smartphones, even if the final assembly happens here, the cost of those components goes up, and guess who ends up footing the bill? Yep, you and me.

This isn't just a theoretical exercise; it's a very real scenario that plays out in marketplaces worldwide. Businesses that rely on imported materials or finished goods have to adapt. They might try to absorb some of the cost, but eventually, that burden tends to land on the consumer. It’s a bit like adding an extra ingredient to a recipe – even if it’s just a pinch, it changes the overall flavor (and cost) of the final dish.

Think of tariffs as a toll booth on the road of international trade. Someone has to pay the toll, and often, it ends up being the person at the checkout counter.

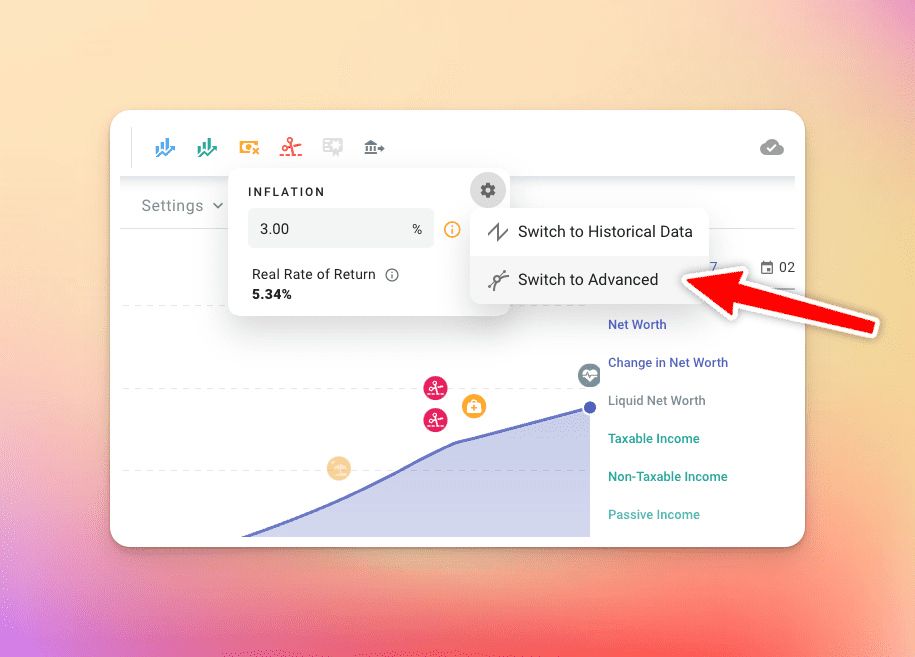

How can I model an inflation spike? - ProjectionLab

Beyond the Price Tag: The Broader Economic Sway

The impact of tariffs extends far beyond the immediate price increase of specific items. When tariffs make imported goods more expensive, consumers might start looking for cheaper alternatives. This can lead to a shift in demand, potentially boosting sales for domestic producers who compete with those imported goods. However, it’s not always a straightforward win for local businesses. If those domestic producers also rely on imported raw materials or components that are now subject to tariffs, their own costs go up, negating some of the potential benefits.

Furthermore, countries often retaliate with their own tariffs on goods imported from the country that initially imposed them. This can lead to what's known as a trade war. Imagine a game of economic tit-for-tat. If Country A puts tariffs on Country B’s steel, Country B might retaliate by putting tariffs on Country A’s agricultural products. This back-and-forth can disrupt global supply chains, create uncertainty for businesses, and ultimately lead to higher prices across a wider range of goods and services. The result? A general uptick in the cost of living – that 2026 Inflation Spike we're talking about.

Your Wallet on the Front Lines

So, how does all this economic jargon translate to your day-to-day expenses? It’s about the sum of all those little price increases adding up. That weekly grocery shop might cost a bit more. Filling up your car could feel pricier. Even services that rely on imported technology or materials can see their costs go up, and those savings are rarely passed on to the customer.

The correlation between new tariffs and your wallet becomes clearer when you start noticing the small changes. It’s not just one item; it’s the aggregate effect. When the cost of producing or importing nearly everything sees a slight increase, that adds up significantly over time. This is where the 2026 Inflation Spike becomes a tangible concern, affecting your purchasing power and the overall stability of your household budget.

Understanding these economic mechanisms empowers you. It allows you to make more informed decisions, whether it’s adjusting your budget, looking for deals, or simply understanding the broader economic forces at play. The world of economics might seem complex, but by breaking down concepts like tariffs and inflation, we can all become a little more financially savvy. Keep an eye on those headlines, and remember, your wallet is directly connected to the decisions made on the global economic stage!