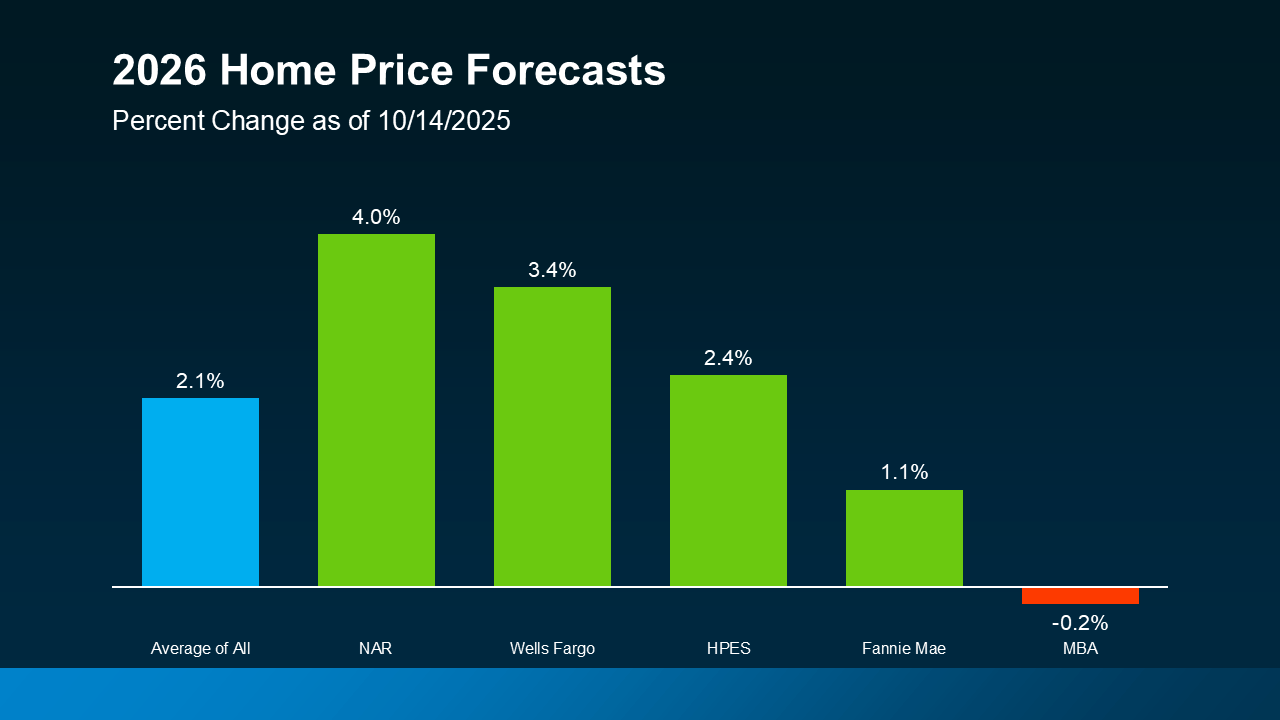

Okay, let's talk about the 2026 housing market. I know, I know, the word "market" can send shivers down your spine. It usually means higher prices and even higher headaches. But hear me out on this one. What if the numbers are telling us something good is coming?

We've been hearing a lot about "lower growth stats." It sounds a bit like a diet plan gone wrong, doesn't it? Like the housing market decided to skip dessert. But in this case, fewer brownies might be a good thing. Stick with me here.

Think of it like a party. If everyone is crammed into a tiny room, it gets hot, uncomfortable, and nobody can even get a decent snack. The prices go up because everyone's fighting for the last chip. That's kind of what a "hot" housing market feels like. Demand is through the roof, and sellers are basically doing a happy dance.

But what happens when the party gets a little... chill? When fewer people are desperately trying to squeeze through the door? The vibe shifts. Suddenly, it's not such a mad dash. Sellers might actually have to work a little. And guess what? That's where the magic happens for us regular folks.

Lower growth stats often mean things are cooling down. The frenzy is subsiding. It's like the housing market is taking a deep breath. And when the market takes a deep breath, guess who else might get to exhale? You and me, the hopeful homebuyers.

Now, let's talk about something everyone's thinking about: mortgage rates. These numbers have been doing more dramatic ups and downs than a soap opera character. For a while there, they felt like they were on a rocket ship to the moon. Ouch.

But here's the quirky twist. When the housing market slows its roll, when the "growth stats" are less, well, growth-y, it often signals to the big players that things are getting a bit more stable. They're not seeing the same insane rush.

And when things stabilize, the Federal Reserve (yes, the grown-ups in charge of money stuff) might feel more comfortable adjusting their game. They look at all these numbers, including the housing market's chill-out session, and think, "Hmm, maybe we can ease up a bit."

This "easing up" can directly impact mortgage rates. It's not a guarantee, of course. The economy is a tricky beast. But the theory is that when the demand for houses isn't a wildfire, lenders don't have to charge as much to make their money. They're not in a panic mode anymore.

Imagine a popular concert. When tickets are scarce and everyone wants one, the resale prices go wild. But if there are tons of empty seats, the scalpers start dropping their prices, right? It's a similar concept. Less competition means less pressure on prices.

So, those "lower growth stats" we've been hearing about? Instead of picturing a shrinking economy, try picturing a less-sweaty, less-stressful housing party. A party where the music is still good, but there's actually room to dance.

This could mean that by 2026, we might see mortgage rates that are a bit more… manageable. A bit more friendly. A bit more like a gentle breeze instead of a hurricane.

It's a bit of an "unpopular opinion," I guess. Many people hear "slowing growth" and think "bad news." But sometimes, in the wild world of real estate and interest rates, a little bit of less can actually be a whole lot more. More affordable, more attainable, and dare I say, even a little more joyful for those of us dreaming of owning a place.

So, the next time you hear about those stats, don't groan. Just maybe… smile. Because that quiet might just be the sound of your mortgage rate taking a much-needed vacation.

It's like the market is saying, "Take your time, folks. We've got plenty of space."

Think of the possibilities! More breathing room in your budget. Maybe even a little extra cash for, you know, actual furniture and not just the essentials. It’s a thought, isn’t it?

So, let's keep an eye on those seemingly boring numbers. They might just be whispering sweet nothings about a brighter, more affordable housing future. And who wouldn't want to hear that?