Hey there, oil enthusiasts and curious minds! Ever find yourself wondering why the price of gasoline at the pump suddenly decides to do a little dance, leaping up or taking a dramatic dive? It’s not magic, and it’s definitely not the car fairy. A huge part of the rollercoaster ride of oil prices, especially for our beloved Brent Crude, is something called speculation.

Think of it like this: imagine a bunch of people are all gathered around a giant, super-important pizza. Everyone thinks this pizza is going to be incredibly delicious and everyone will want a slice. So, even before anyone has actually tasted it, people start offering more and more money for a guaranteed future slice. That’s kind of what speculators do with oil!

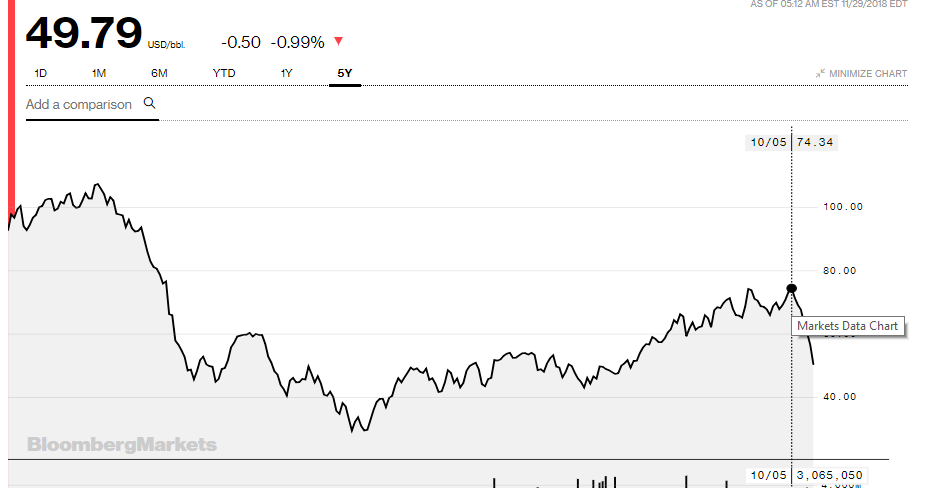

Now, let’s talk about Brent Crude. It’s a major type of oil, like the VIP of the oil world, traded all over the globe. Its price is like the speedometer of the global economy; when it’s high, things are generally humming along, and when it’s low, well, maybe everyone’s a bit more cautious with their spending.

So, what’s making Brent Crude feel like it’s on a trampoline lately? One of the biggest buzzkills – or shall we say, price-boosters – is the looming shadow of potential trouble in Iran. You see, Iran is a big player in the oil game, like a seasoned chef with a secret spice blend that the whole world wants.

If there’s even a whisper of conflict, or the possibility of strikes on Iran, the oil market starts to sweat. It’s like hearing that your favorite pizza place might suddenly close for renovations – you’d probably rush to stock up, right? Well, the world does something similar with oil.

Speculators, those pizza-slice hustlers, get incredibly jumpy. They start imagining scenarios where Iran's oil supply could be disrupted. And even if that disruption doesn't actually happen, the fear of it is enough to send ripples through the market. It’s the power of what might be!

Imagine you’re at a concert, and the lead singer might have a sore throat. Suddenly, people start buying up all the souvenir t-shirts because they’re worried they won’t get another chance. That’s the speculative frenzy! They’re not buying based on today's oil production; they’re buying based on their educated (or sometimes, wildly uneducated!) guesses about tomorrow.

When speculators anticipate a future shortage, they’ll buy up oil contracts now, hoping to sell them later at a higher price. This increased demand, even if it's just the promise of demand, drives the current price of Brent Crude up. It’s like a self-fulfilling prophecy fueled by anxiety and the potential for profit.

Think of the oil market as a giant, very sophisticated guessing game. The players aren't just looking at the current score; they're trying to predict the final score, the weather at the next game, and whether the star player will get a cramp!

The potential for strikes on Iran is a huge variable in this game. Iran is one of the world’s major oil producers, and any threat to its ability to pump oil is like taking a significant chunk of that precious pizza off the table before it’s even served.

This uncertainty creates a breeding ground for speculation. Traders and investors are constantly weighing the odds, reading the news, and trying to get ahead of the curve. Are tensions rising? Is a deal being brokered? Every headline is a potential clue.

So, when you see Brent Crude prices making big moves, remember it’s not just about the oil currently flowing from the ground. It’s also about the whispers, the fears, and the bold predictions about what could happen next, especially when a major player like Iran is involved.

The market reacts to potential disruptions just as strongly, if not more strongly, than actual ones. It’s the anticipation of scarcity that drives prices skyward. If everyone believes there will be less oil available, they act as if there is.

This is why Brent Crude can be so volatile. It's a highly sensitive commodity, and its price is a reflection of global anxieties, geopolitical events, and the collective crystal ball gazing of thousands of traders.

Imagine the price of your favorite snack suddenly doubling because there’s a rumor that the factory making it might have to shut down for a week. You’d probably rush to buy it before it disappears, right? That’s the same psychology at play, but on a global scale with a commodity as crucial as oil.

The situation with Iran is a classic example. The mere possibility of conflict, or sanctions that could cut off its oil exports, sends shivers down the spines of oil traders. They then start adjusting their bets, and those adjustments have a real-world impact on prices.

It’s like a game of dominoes. A single event, or even the threat of an event, in one part of the world can trigger a chain reaction across the entire oil market. And Iran, with its significant oil reserves, is a pretty big domino.

So, the next time you see those gas prices fluctuate wildly, you can nod knowingly. It’s the fascinating, sometimes baffling, world of oil speculation, where future possibilities are traded just as fiercely as present realities, especially when Iran and its vital oil supply are in the spotlight.

These speculators are like weather forecasters for the economy. They’re constantly looking at the clouds – in this case, geopolitical clouds around Iran – and predicting the storm that might hit the oil market.

And their predictions, their bets, and their anxieties are a massive force shaping the price of Brent Crude. It’s a complex dance of supply, demand, and a whole lot of ‘what ifs’!

It's truly a testament to how interconnected our world is. A rumour in the Middle East can feel like a direct hit to your wallet at the pump, all thanks to the power of speculation on commodities like Brent Crude.

So, there you have it! The price of oil isn't just about what's being pumped out of the ground today. It's also a reflection of the hopes, fears, and very active imaginations of people all over the world, especially when the stability of oil from places like Iran is in question. Pretty wild, right?