Let's talk about money. Specifically, the money that makes businesses tick. You might have heard terms like Called Up Capital and Paid Up Capital. They sound a bit serious, don't they? Like something you'd discuss over a very important, slightly stale biscuit. But stick with me. We can make this fun. I promise. Well, as fun as discussing capital can be, anyway. Think of it as a little peek behind the curtain of grown-up finance, without the confusing jargon.

So, imagine you’re starting a lemonade stand. A really fancy one. You need some initial funds. Your generous Uncle Steve says, "I'll give you a thousand bucks!" Great! That's a start. But here’s where it gets interesting. Uncle Steve might say, "Okay, I'm committing a thousand dollars, but I'll give you half now and the other half next month, when I've cashed in that lottery ticket I'm sure is a winner."

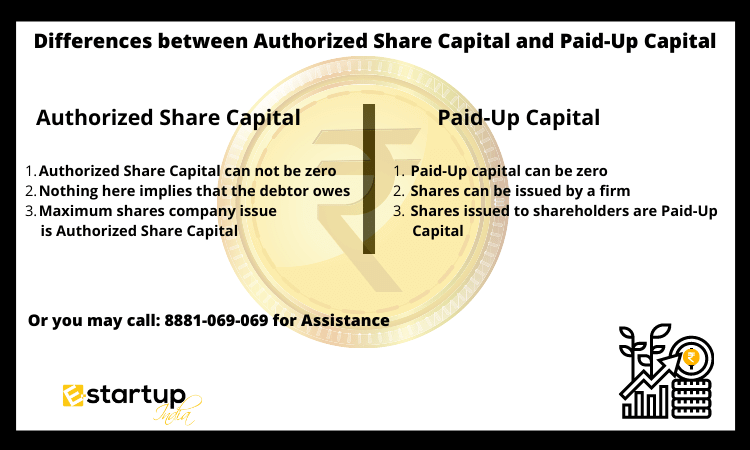

That initial thousand dollars he promised? That's like our Authorized Capital. It's the big number, the potential. It's the dream. It's the "what could be." It’s the theoretical limit of how much money your lemonade empire could have.

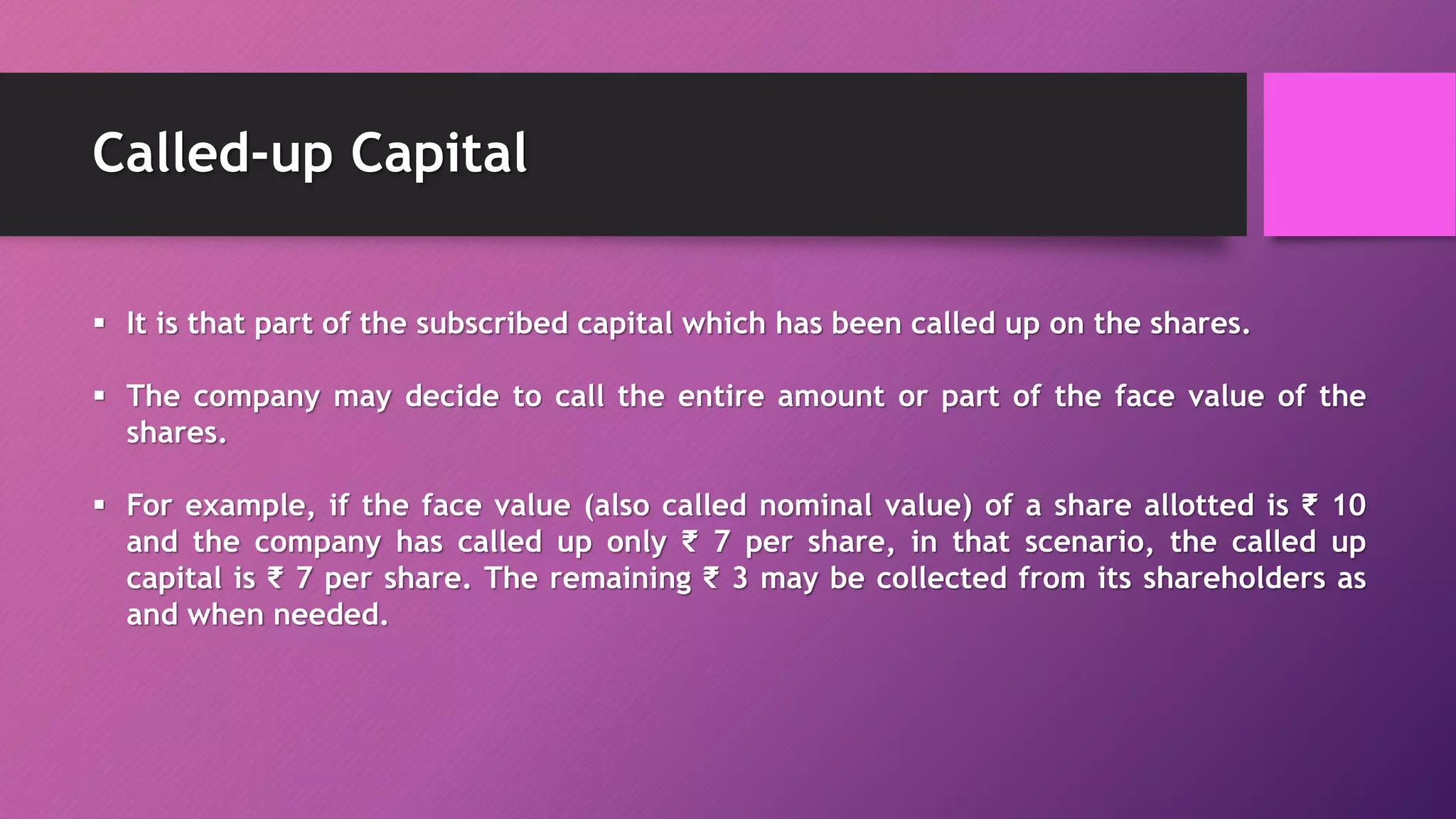

Now, the five hundred dollars he hands you right away? That's the beginning of our story. This is where Called Up Capital starts to play a starring role. Think of it as the part of Uncle Steve’s promised money that you, the savvy lemonade entrepreneur, have asked for. You've "called it up." You've said, "Hey, Uncle Steve, remember that money? Could you send it over now? I need to buy more lemons. And perhaps a tiny, sparkly hat for the stand."

So, Called Up Capital is the portion of the total money promised that the company (that's you, the lemonade maestro) has requested from its investors (your dear Uncle Steve). It’s the active part of the promise. It's the "come on, hand it over!" moment.

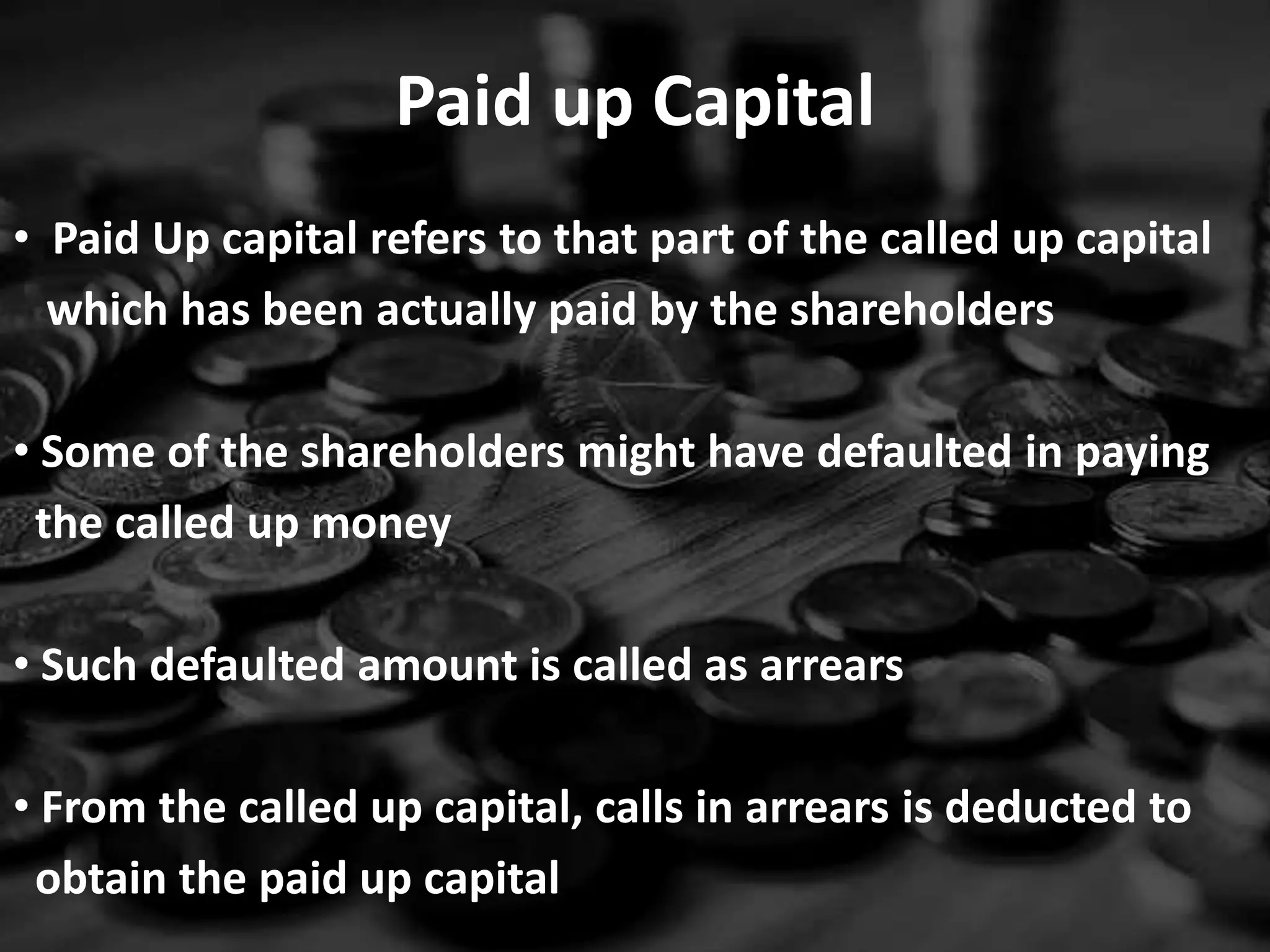

But what if Uncle Steve is a bit… forgetful? Or, more likely, what if his lottery ticket wasn't a winner? He promised the other five hundred, but he can’t quite deliver. He still owes you that money, mind you. It’s still part of the deal. But he hasn't actually given it to you yet.

This is where Paid Up Capital waltzes in, looking all official. Paid Up Capital is the money that has actually been paid into the business. It's the cash in your hand. It's the money you can physically use to buy more lemons, perhaps even a second-hand ice cream machine (ambitious, I know!).

So, in our lemonade stand example, if Uncle Steve gave you $500 initially and promised another $500 that he hasn't paid yet, then:

:max_bytes(150000):strip_icc()/paidupcapital.asp-final-46ec06676a584bc4b0eb1f2d9f65a73f.png)

- His total commitment was $1000 (Authorized Capital).

- You've asked for $1000 (let's say you decided to call it all up at once to be bold). This would be the Called Up Capital.

- But only $500 has landed in your lemonade stand's till. That $500 is your Paid Up Capital.

It’s like ordering a fancy pizza. The menu says it costs $20 (Authorized Capital). You tell the waiter you want the whole pizza, right now (Called Up Capital). But you only have $15 in your pocket. So, you pay the $15 (Paid Up Capital), and you still owe $5. The restaurant is hoping you'll magically find that $5 later.

The difference between Called Up Capital and Paid Up Capital is the money that's been requested but not yet received. It's the "almost there" money. It's the slightly embarrassing "I still owe you" of the business world. It's the gap between a promise and a transaction.

Companies need both. They need the potential (Authorized Capital), they need to signal what they expect to receive (Called Up Capital), and most importantly, they need the actual cash to operate (Paid Up Capital). Without Paid Up Capital, your lemonade stand is just a really enthusiastic promise of deliciousness. And nobody buys lemonade from a promise, do they?

So, the next time you hear these terms, don't get intimidated. Just picture Uncle Steve and his lottery ticket, or your pizza order. It's all about the money that's been promised, the money that's been asked for, and the money that's actually in the bank. It’s the difference between saying "I will" and saying "I did." And in business, as in life, the "I did" is usually a lot more useful.

My unpopular opinion? These terms are actually quite charming. They have a certain old-school, slightly formal, but ultimately straightforward feel to them. They're like a friendly nod from the financial world, saying, "We're talking about real money here, folks!" And that's something worth smiling about. Even if it involves the potential absence of five dollars for pizza.