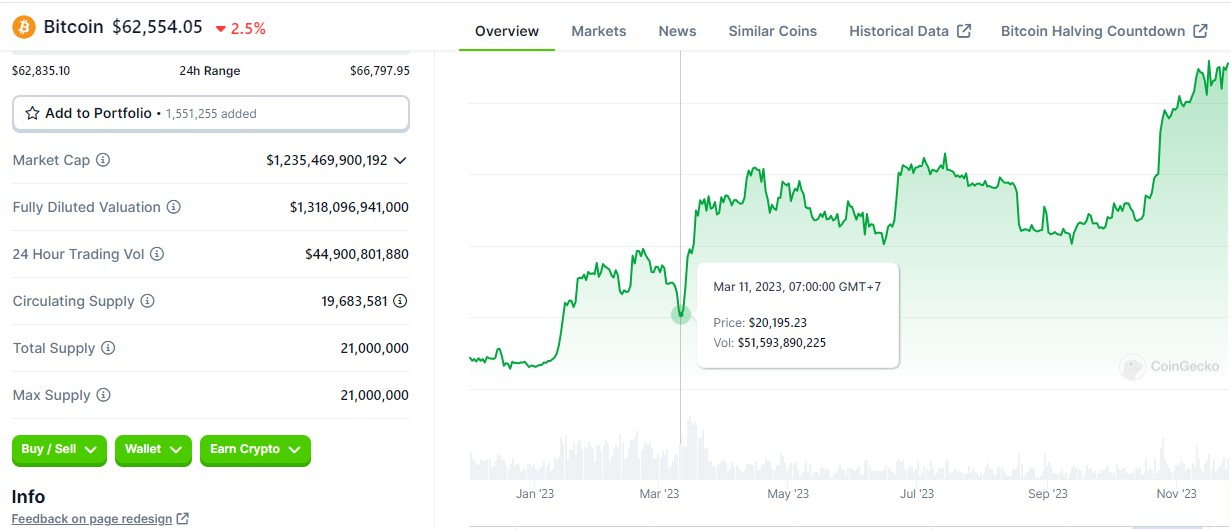

Hey there, fellow digital nomads and crypto curious! Let's grab a virtual latte and chat about something that's been buzzing in the crypto ether, and frankly, on everyone’s mind: Bitcoin hitting that sweet, sweet $67,900 mark. It’s a number that makes your crypto wallet do a little happy dance, right? But what’s really behind this spike, especially when whispers of a 2026 US economic slowdown are starting to get louder than a dial-up modem trying to stream Netflix?

Think of it like this: the economy is like a music festival. Sometimes it's all sunshine and booming basslines, everyone's buying merch and feeling good. Other times, the skies darken, the Wi-Fi gets spotty, and people start clutching their wallets a little tighter. That’s where Bitcoin, in its digital, decentralized glory, seems to be playing a different tune.

So, is Bitcoin the ultimate hedge fund for the apocalypse, or just a really, really fancy digital asset that’s good at dodging economic storms? Let’s dive in.

The Crypto Conga Line: Why the Big Bucks?

First off, the $67,900 isn't just a random number; it's a testament to a few key things happening in the crypto universe. We've seen a significant uptick in institutional adoption. Remember when big banks and investment firms were like, "Crypto? Is that even legal?" Now, they're not just dipping their toes in; they're diving headfirst, buying up Bitcoin like it’s the last avocado toast on a Sunday morning. This injection of serious capital from the big players lends a lot of credibility and, let’s be honest, drives up the price.

Then there’s the whole halving event. If you're not familiar, it's basically Bitcoin's built-in scarcity mechanism. About every four years, the reward for mining new Bitcoins is cut in half. Think of it like a limited edition vinyl release – the fewer there are, the more people want them, and the price can skyrocket. The most recent halving happened in April 2024, and historically, these events have often preceded significant price surges. So, we’re seeing that ripple effect play out.

And let’s not forget the sheer cultural momentum. Bitcoin is no longer just for the tech geeks in dimly lit basements. It’s in the headlines, it's being discussed at dinner parties (remember those?), and it's even being integrated into everyday transactions, albeit slowly. This growing awareness and acceptance make it more accessible and desirable.

When the Economy Sings the Blues, Bitcoin Roars?

Now, onto the juicy part: the 2026 US economic slowdown. Economists are using terms like "recession" and "stagflation" with a bit more frequency these days, and it’s got many people feeling that familiar economic anxiety. When traditional markets get wobbly, investors often start looking for safer havens. For a long time, that meant gold. But in the digital age, Bitcoin has emerged as a strong contender for that ‘digital gold’ status.

Why? Because Bitcoin operates largely independently of traditional financial systems. It’s not tied to any single government or central bank. When inflation starts gnawing at your fiat currency (that's your regular money, folks!), and the Fed is raising interest rates, Bitcoin can seem like a breath of fresh, decentralized air. It's like finding a hidden speakeasy during a city-wide lockdown – a place where you can still conduct transactions and store value, away from the chaos.

Some argue that Bitcoin's value proposition as a scarce, digital asset makes it a compelling alternative when fiat currencies might be losing their purchasing power. If the government prints more money to stimulate the economy, your existing money buys less. Bitcoin, with its capped supply of 21 million coins, can't be devalued in the same way. This inherent scarcity is a major draw for those worried about economic uncertainty.

Think of it like this: if your local coffee shop starts watering down their espresso to make more profit during tough times, you might start looking for that hidden gem of a cafe that still uses premium beans. Bitcoin, in this analogy, is that premium bean cafe.

Navigating the Crypto Currents: Practical Tips

So, if you’re feeling intrigued by Bitcoin’s resilience in the face of economic headwinds, what’s a savvy, easy-going individual to do? First, remember that investing is not a spectator sport. You gotta get involved, even if it’s just a small amount to start. Think of it like learning to play an instrument – you don’t become a virtuoso overnight. Start with a few chords.

Do your homework. Seriously. Before you throw your life savings at Bitcoin (please, don't!), understand what you're buying. Read up on the technology, the market trends, and the risks. There are tons of amazing resources out there, from reputable crypto news sites to beginner-friendly YouTube channels. It’s like researching a new travel destination before booking that flight – you want to know what you’re getting into.

Start small. You don’t need to buy a whole Bitcoin. You can buy fractions of a Bitcoin, known as satoshis (named after Bitcoin’s mysterious creator, Satoshi Nakamoto – how cool is that?). Think of it like buying a single vinyl instead of a whole record store. Set a budget you're comfortable with, and stick to it. dollar-cost averaging (DCA) is your friend here – buying a fixed amount of Bitcoin at regular intervals, regardless of the price. It smooths out the volatility and takes the guesswork out of timing the market.

Security is king. Once you buy Bitcoin, you need to keep it safe. This means using reputable exchanges and, more importantly, considering a hardware wallet. These are like a digital Fort Knox for your crypto. Leave it to the pros to handle the heavy lifting of security.

Diversify (but not too much). While Bitcoin is the big player, the crypto space is vast. It’s wise to understand other cryptocurrencies, but don't get lost in the altcoin rabbit hole without proper research. Stick to what you understand, especially in the early days.

Don't panic sell. The crypto market is known for its wild swings. If you see the price dip, resist the urge to hit that sell button in a panic. Remember, Bitcoin has historically shown a remarkable ability to recover and reach new highs. Think of it as a rollercoaster; there are ups and downs, but the ride can be exhilarating.

Cultural Vibes and Fun Facts

You know, the whole Bitcoin phenomenon feels like a modern-day gold rush, but with less dust and more data. It’s like when everyone suddenly started collecting Beanie Babies, but with actual economic implications. The language of crypto is a whole new dialect: “HODL” (hold on for dear life), “FUD” (fear, uncertainty, and doubt), “to the moon!” It’s a vibrant, sometimes meme-filled, subculture.

Did you know that the very first Bitcoin transaction ever was for 10,000 Bitcoins to buy two pizzas? At today's prices, that would be worth over 679 million dollars! Talk about an expensive slice of pepperoni. It’s a fun reminder of how far this technology has come from its quirky beginnings.

And the sheer decentralized nature of Bitcoin has fueled a lot of discussion about the future of finance, privacy, and individual sovereignty. It's like when the internet first emerged – nobody really knew what it would become, but it clearly changed everything. Bitcoin is arguably doing something similar for money.

It's also fascinating to see how different cultures are adopting and reacting to Bitcoin. In some countries grappling with hyperinflation, Bitcoin has become a lifeline. In others, it's a speculative investment. It's a global phenomenon with localized impacts, a truly modern paradox.

The rise of Bitcoin and other cryptocurrencies also influences art, music, and fashion. You see NFTs (non-fungible tokens) being bought and sold, digital art being created, and even crypto-themed merchandise. It’s a cultural zeitgeist that’s still unfolding.

A Little Reflection for Your Everyday

So, what does Bitcoin at $67,900, and the looming economic slowdown, mean for us in our daily lives? It’s a reminder that the world of finance isn’t static. It’s evolving, and technologies that seemed like science fiction a decade ago are now impacting our wallets and our future.

For many, it's an invitation to become more financially literate, to understand where our money is going and how it's being influenced by global events. It’s about taking a proactive approach to our financial well-being, rather than just being passive observers.

Even if you decide that Bitcoin isn't for you, the underlying principles of scarcity, decentralization, and digital innovation are becoming increasingly important. It's like understanding how to use a smartphone even if you prefer to write letters; the technology has fundamentally altered communication, and understanding it can empower you.

Ultimately, the conversation around Bitcoin and economic uncertainty is a call to think differently about value, security, and the future. It’s about staying curious, staying informed, and perhaps, just perhaps, being a little more adventurous with your financial journey. Now, about that second virtual latte...